No one likes to talk about Life Insurance. It’s confusing and the salesman is sometimes pushy.

But understanding it and planning ahead can help protect your loved ones financially when you die. Life insurance helps provide financial security in an otherwise turbulent time. Whether used to maintain a lifestyle, invest in the future, or pay off debt or final expenses, life insurance offers flexibility in accomplishing financial goals.

I’m here to help you to understand your option, find a plan that suits your needs, and shop around many companies to give you the best value. For your free quote, contact us NOW!

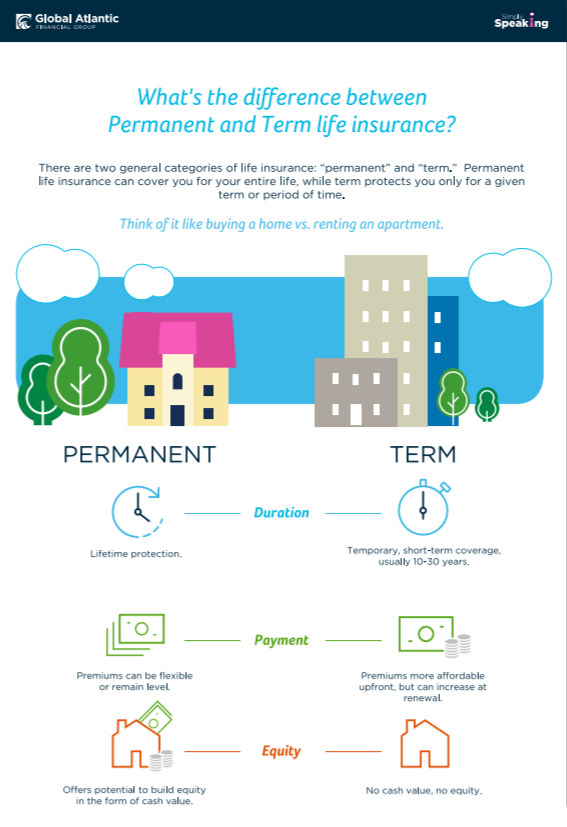

PERMANENT VERSUS TERM

What’s the difference between Permanent and Term Life insurance? To answer, please review this infographic below.

HOW DO YOU USE PERM AND TERM?

Term life insurance is a great tool to protect your liabilities for a shorter period of time such as when you’re taking a new mortgage or protecting your family while your kids are still little.

Permanent is another great tool to build your saving, to pay your final expense or debts. When you add a long term care rider to it, you’ll have some money for your long term care expenses in the future in case you would need it. Or simply, just to leave a legacy of your wealth to your loved ones when you pass away. One example is Final Expense Life Insurance.

It’s a great idea to strategize using both tools, Term and Permanent life insurance, to accomplish your financial goal while protecting your family. Contact me for your free consultation.