Medicare costs are rising in 2026 — and that can affect every beneficiary’s monthly budget. The Centers for Medicare & Medicaid Services (CMS) has confirmed increases to several key components, including Medicare Part B premiums, deductibles, and income-related surcharges (IRMAA) for higher-income enrollees.

Medicare costs are rising in 2026 — and that can affect every beneficiary’s monthly budget. The Centers for Medicare & Medicaid Services (CMS) has confirmed increases to several key components, including Medicare Part B premiums, deductibles, and income-related surcharges (IRMAA) for higher-income enrollees.

Part B Standard Premiums and Deductibles

For most beneficiaries, the standard Medicare Part B premium in 2026 will be:

- $202.90 per month, up from roughly $185 in 2025.

Additionally, the annual Part B deductible will increase to $283.

If your income is above certain thresholds, you’ll pay extra through IRMAA — the Income-Related Monthly Adjustment Amount, which applies to both Part B and Part D premiums.

What is IRMAA?

IRMAA is an additional monthly surcharge on your Medicare Part B and Part D premiums if your Modified Adjusted Gross Income (MAGI) from two years prior exceeds specified income brackets. For 2026, these brackets are based on your 2024 tax return. You can find out if you have this surcharge by reviewing your Medicare invoice or the letter Medicare sent you before the end of the year explaining your new Medicare premiums for the following year. As always, if you have questions about your Medicare bill, please contact Medicare (1-800-Medicare) directly to inquire.

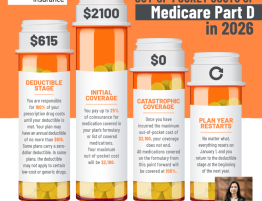

2026 Medicare Premiums by Income Bracket

Below is a summary of Medicare Part B premiums and Part D IRMAA surcharges for 2026:

| Income Bracket (MAGI filed 2024) | Part B Monthly Premium (2026) | Part D IRMAA Surcharge (2026) |

|---|---|---|

| ≤ $109,000 (individual) / ≤ $218,000 (joint) | $202.90 | $0 + your plan premium |

| $109,001–$137,000 / $218,001–$274,000 | $284.10 | + $14.50 + your plan premium |

| $137,001–$171,000 / $274,001–$342,000 | $405.80 | + $37.50 + your plan premium |

| $171,001–$205,000 / $342,001–$410,000 | $527.50 | + $60.40 + your plan premium |

| $205,001–$499,999 / $410,001–$749,999 | $649.20 | + $83.30 + your plan premium |

| ≥ $500,000 / ≥ $750,000 | $689.90 | + $91.00 + your plan premium |

Source: CMS income ranges and 2026 Part B/Part D premium adjustments.

📌 Note: The Part D surcharge listed is added on top of your chosen prescription drug plan’s premium — so the total Part D cost varies based on the plan you select.

👉 Want the complete 2026 Medicare cost breakdown — including Part A details, deductibles, coinsurance, and IRMAA calculations? Download your free 2026 Medicare cost file here.

How to Appeal an IRMAA Determination

Many Medicare beneficiaries are surprised to learn that IRMAA is based on income from two years ago. For retirees, that often means Medicare premiums are calculated using income levels that no longer reflect today’s income. In some cases, an IRMAA appeal can help lower Part B and Part D costs.

When an IRMAA Appeal May Be Worth Reviewing

You may be eligible for an IRMAA adjustment if your income decreased due to one of these life-changing events:

- Retirement or reduction in work hours

- Marriage, divorce, or death of a spouse

- Loss or reduction of pension income

- Loss of income-producing property

- Financial loss due to a natural disaster

These situations are especially common for new Medicare enrollees who have just retired, and appeals are often successful when properly documented.

What the IRMAA Appeal Process Looks Like

IRMAA appeals are handled through the Social Security Administration, but the process doesn’t have to feel confusing.

-

Complete SSA Form 44

This form explains what changed and estimates your current-year income. To obtain the latest form, visit ssa.gov, then click “Medicare” on the top menu, followed by “Request to Lower IRMAA”. You can download the form there. -

Gather Supporting Documentation

This may include retirement notices, pension statements, pay stubs showing reduced income, or legal documents. -

Submit the Appeal to Social Security

Sign in to your Social Security account and upload your completed form and documents. Or fax or mail to your local Social Security office. If approved, Social Security will reduce your Part B and Part D premiums and may refund overpaid amounts.

Why Timing Matters

While IRMAA appeals can be filed at any time, acting sooner can prevent months of unnecessarily higher premiums. Even one IRMAA tier can significantly increase annual Medicare costs.

How We Help

As an independent insurance broker, we focus on personal guidance—not one-size-fits-all advice. Our goal is to help you understand your Medicare costs and the plan options available to you. Schedule your no-cost Medicare Consultation today — no pressure, just helpful guidance.

Disclaimer:

This post was generated by AI and has been edited and validated by our staff. This is a general guideline for educational purposes only. Your situation may be different and require different approaches. Please contact us to request your personal consultation.